Get the free irs form14420

Show details

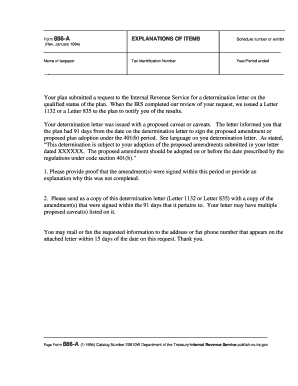

Form 14420 (February 2013) Department of the Treasury Internal Revenue Service OMB Number 1545-2236 Verification of Reported Income Taxpayer name Taxpayer Identification Number For tax year ending

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs form14420 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form14420 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs form14420 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs 14420 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out irs form14420

How to fill out IRS Form 14420:

01

Begin by carefully reading the instructions provided with the form. These instructions will guide you through the process and provide valuable information on how to accurately complete the form.

02

Start with the first section of the form, which typically asks for general information such as your name, address, and Social Security number. Ensure that all the information provided is accurate and up to date.

03

Proceed to the subsequent sections of the form, which may require you to provide specific details related to the purpose of the form. Follow the instructions closely and provide the necessary information requested.

04

If any section of the form requires additional documentation or attachments, make sure to include them as instructed. Failure to submit the required documents may result in delays or complications in processing your form.

05

Double-check your entries before submitting the completed form. It is crucial to ensure that all the provided information is correct, legible, and corresponds accurately to your situation.

06

If you have any questions or uncertainties while filling out the form, seek guidance from the IRS or a tax professional. They can provide valuable assistance and clarify any doubts you may have.

Who needs IRS Form 14420:

01

IRS Form 14420 is typically required by individuals or entities that want to request certification as qualified opportunity zone (QOZ) businesses or qualified opportunity funds (QOFs). These designations are associated with certain tax benefits provided under the Opportunity Zone program.

02

QOZ businesses are those operating in designated economically distressed areas known as opportunity zones. By completing Form 14420 and obtaining certification, these businesses may be eligible for tax incentives and other benefits associated with investments in these zones.

03

QOFs, on the other hand, are investment vehicles that direct capital into qualified opportunity zone businesses. By filing Form 14420, QOFs can apply for certification and take advantage of the tax benefits provided under the Opportunity Zone program.

04

It is important to thoroughly review the eligibility criteria and requirements outlined by the IRS for Form 14420 to determine whether you fall into the category of individuals or entities that need to fill out this form.

05

If you are unsure about your eligibility or have specific questions regarding the form, it is advisable to consult with a tax professional or seek guidance from the IRS directly. They can provide you with the necessary information and clarification to determine if you need to fill out Form 14420.

Fill form : Try Risk Free

People Also Ask about irs form14420

What is the IRS form for missing W-2?

How do I get a copy of my 1099 from the IRS?

What do I do if I lost my W-2 form?

Will the IRS catch a missing W-2?

How do I get a missing W-2 from the IRS?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs form14420?

IR-14420, or Form 14420, is a form used by the Internal Revenue Service (IRS) to request taxpayer assistance in verifying claims for the Advance Premium Tax Credit (APTC) on their federal income tax return.

Who is required to file irs form14420?

Individuals who have received advance payments of the Premium Tax Credit (APTC) and choose to reconcile them on their federal income tax return are required to file IRS Form 14420.

How to fill out irs form14420?

To fill out IRS Form 14420, taxpayers need to provide their personal information, including their name, Social Security number, address, and tax year for which they are filing. They must also report their income, advanced payment amount, and reconcile any differences between the advance payment and their actual credit using the information provided by Form 1095-A.

What is the purpose of irs form14420?

The purpose of IRS Form 14420 is to reconcile any differences between the advance payments of the Premium Tax Credit (APTC) that taxpayers received and the amount they are eligible for on their federal income tax return. This form helps the IRS verify the accuracy of the APTC claims made by taxpayers.

What information must be reported on irs form14420?

Taxpayers filing IRS Form 14420 must report their personal information, including their name, Social Security number, and address. They must also report their income, the amount of advance payments received, and reconcile any discrepancies between the advance payment and the actual credit using Form 1095-A.

When is the deadline to file irs form14420 in 2023?

The deadline to file IRS Form 14420 in 2023 is typically April 15, unless an extension is granted. It is advisable to check the official IRS website or consult with a tax professional for the most accurate and up-to-date deadline information.

What is the penalty for the late filing of irs form14420?

The penalty for the late filing of IRS Form 14420 is usually calculated based on the amount of tax owed. The penalty can vary depending on the specific circumstances of the taxpayer, so it is advisable to consult with a tax professional or refer to the official IRS guidelines for the most accurate information regarding penalties.

How can I manage my irs form14420 directly from Gmail?

irs 14420 form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit form 14420 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including irs form 14420, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit irs gov form 14420 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign irsform 14420 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your irs form14420 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 14420 is not the form you're looking for?Search for another form here.

Keywords relevant to tax form 14420

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.